ANIXE Insights 2023.08: Growing Relaxation despite War, Fires and Inflation.

The summer holiday season is in full swing, with our global booking data revealing a surge in sales of more than 20% from June which is also a staggering 50% higher than the pre-pandemic high water mark set in June 2019.

Unfortunately, new signs of trouble loom ahead for the travel industry as global climate change begins to show its teeth. Climate change has brought about chaotic variability in weather patterns leading Croatia, Italy, Spain, and Turkey to suffer summer ice storms. For Spain in particular, a normally dry summer landscape was turned wintery as everything was covered in hail stones, with the resulting thaw causing flooding.

The chaos then continued in Southern Europe as intense heatwaves gripped the region. In Spain, Italy, Greece, and Portugal, fires broke out, turning idyllic getaway locations into a nightmarish hell. Tens of thousands of people were emergency evacuated from their holiday resorts to avoid being engulfed in the flames.

Unfortunately, such travel disruptions are here to stay. With only an average global temperature increase of 1.2C, the increasingly chaotic weather events in the region could spell further disaster for the travel businesses in those areas. Last month unbearable heat forced Greek authorities to close the Acropolis and Italian authorities to request people stay indoors. Could ‘climate lockdowns’ become the new normal for holidaymakers travelling in Southern Europe?

Let’s hope it doesn’t go that far. However, with an increasing risk of climate-related catastrophes, Politico noted that European travel preferences are beginning to change as 7.3% of surveyed tourists take into account extreme weather events when planning their trips. In the wake of highly the recent publicised emergency evacuations, this figure could grow, and the remaining question is, can tourism in Southern Europe survive a substantial drop in demand?

Allianz Research has prepared an analysis of Southern Europe’s attractiveness and future prospects. Unfortunately, the report does not take into account the recent problems with fires and massive heat waves haunting European resorts.

Allianz Trade's analysis shows that beach vacations are the most popular leisure activity (30.3%), but 41% of European travellers expect to spend more than €1,500 on their vacations this summer, up 33% on planned vacation spending last year. Nevertheless, it appears that the average week-long beach vacation in Southern Europe is still significantly cheaper than in the Caribbean, Australia and the United States and comparable to many top destinations in Latin America, Africa and Southeast Asia. Higher prices do not seem to be discouraging vacation planning: Revenue per passenger kilometre (RPK) for travel in Europe in the first quarter of 2023 has already reached 92% of 2019 levels, while air ticket sales volume for the May-September period has also reached 91% of summer 2019 levels.

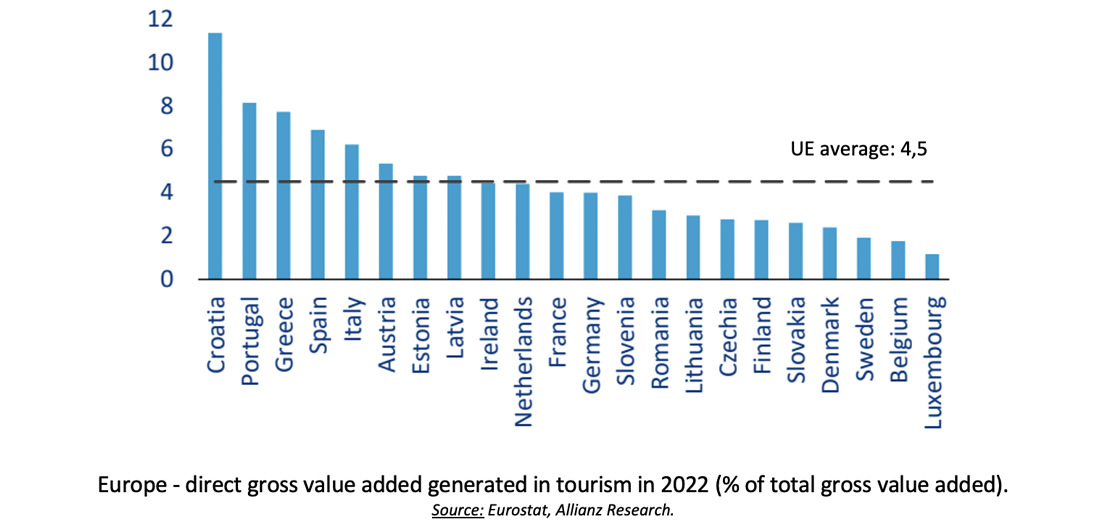

Southern Europe is dependent on tourism. It accounts for the largest share of total gross value added in Croatia (11.3%), closely followed by Portugal (8.1%), Greece (7.7%), Spain (6.9%) and Italy (6.2%). This leads to excessive heavy structural dependence on foreign tourists and increasing vulnerability to exogenous shocks (such as a pandemic). It also threatens to perpetuate the region's inherent structural problems of low-skilled jobs and low productivity.

Not surprisingly, tourism ministers from Southern European countries are trying to play down the seriousness of the ongoing fires in the Mediterranean region and continue to encourage tourists to visit their countries. While this sounds like an underestimation of the threat – the region makes much of its living from tourism, so the annual influx of visitors is vital to keeping the economy running.

On Friday, July 28, it was announced that a campaign to promote Rhodes in major tourist markets will soon be launched. It is to be one of three measures to support tourism on the island, Greek Travel Pages reported. Olga Kefalogianni, Greece's tourism minister, reported that only a small part of the island of Rhodes is on fire and that other parts of the island are beautiful and safe. - There have been no disruptions at the airport, and only 10-20% of the island's total area has been affected by the fire, she told the BBC Today program.

Representatives of the Italian ministry spoke in a similar vein. - The high temperatures [...] do not in any way threaten our tourism offer, which remains solid, high quality, diverse and sustainable, Italian Tourism Minister Daniela Santanchè said in late July. - We look forward to seeing you in Italy.

With the start of the tourism campaign, the two governments will offer direct support to affected residents and businesses through the state aid mechanism, and regional and municipal authorities will immediately begin rebuilding road networks and public beaches.

The reopening of businesses in the affected areas is already underway, and the affected areas are ready to welcome visitors again, while damage reparation for compensation has also begun.

The future of tourism in Southern Europe depends now on the actions taken by the region’s authorities. Can they convince future travellers of their safety? What initiatives will they take to prevent similar catastrophes from occurring again?

Although climate change has the potential to reduce demand, our own data from this year is clear; Summer 2023 has been a success. Let’s take a deeper look at the data.

In July 2023, ANIXE data revealed that global bookings were more than 20% higher than in June 2023 and more than 50% higher than the July 2019 result!!! The German market also showed a strong growth rate, 48% higher than before the pandemic and July 2023 improved June's result by 18%. You can see the booming holiday season, which is not afraid of inflation, war, or fires.

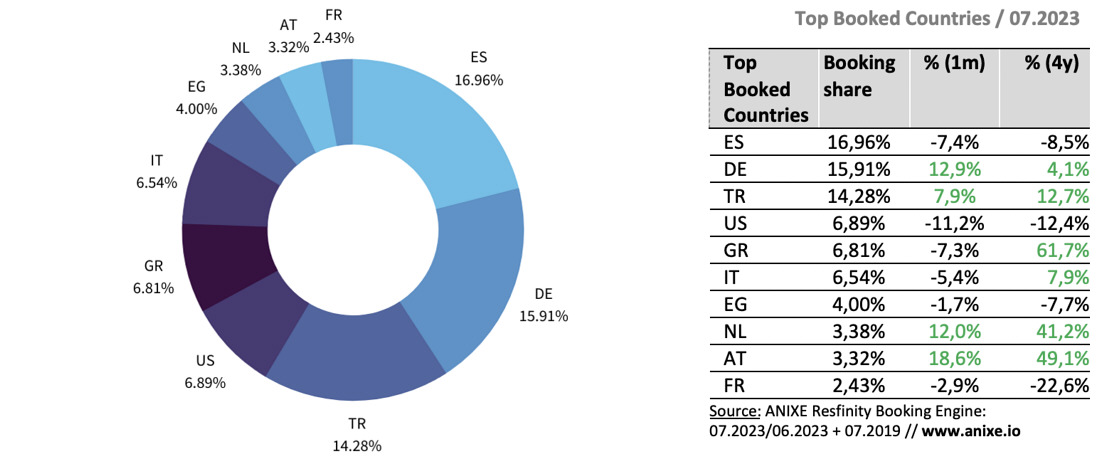

In July 2023, German travellers continued to enjoy travelling to and visiting their preferred destinations, including Spain, Turkey and domestic locations. In particular, the latter two destinations, Turkey and Germany, saw a 12.9% and 7.9% month-on-month increase in interest. In contrast, the largest monthly declines were recorded by the US (11.2%), Spain (7.4%), Greece (7.3%), and Italy (5.4%) and these were undoubtedly related to the massive fires raging in those countries' seaside resorts in July.

Interestingly, the share of Greece and Italy in the portfolio of overall bookings, although clearly declining last month, still remains higher (by 61.7% and 7.9%, respectively) compared to the pre-pandemic period, where Spain led the way significantly.

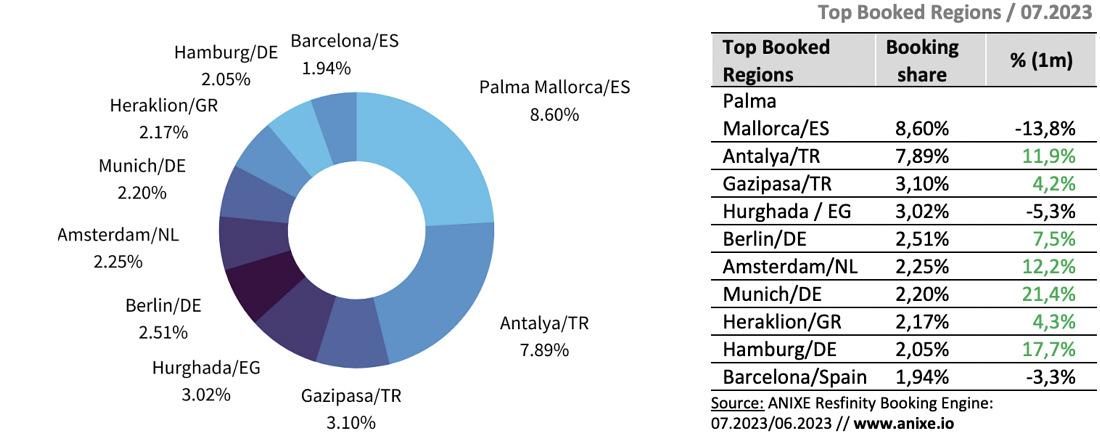

While tourists couldn't resist the magnetic appeal of Spain's Palma Mallorca (8.6%) in July 2023, due to local fires, the choice increasingly fell on two Turkish resorts - Antalya and Gazipasa, whose share of the overall reservoir portfolio increased significantly monthly by 11.9 and 4.2%. Palm Mallorca's share alone declined significantly both monthly by 13.8% and compared to the same period before the pandemic (20.5%)

On a three-year basis, in addition to Spain, two local destinations also experienced declines in popularity: Berlin (16.7%) and Hamburg (4.6%), as well as Egypt's Hurghada (6.3%). In contrast, the Greek resort of Heraklion 136.8% and Turkey's Gazipasa 46.5% are currently more popular. How will travel retailers adapt to these changes?

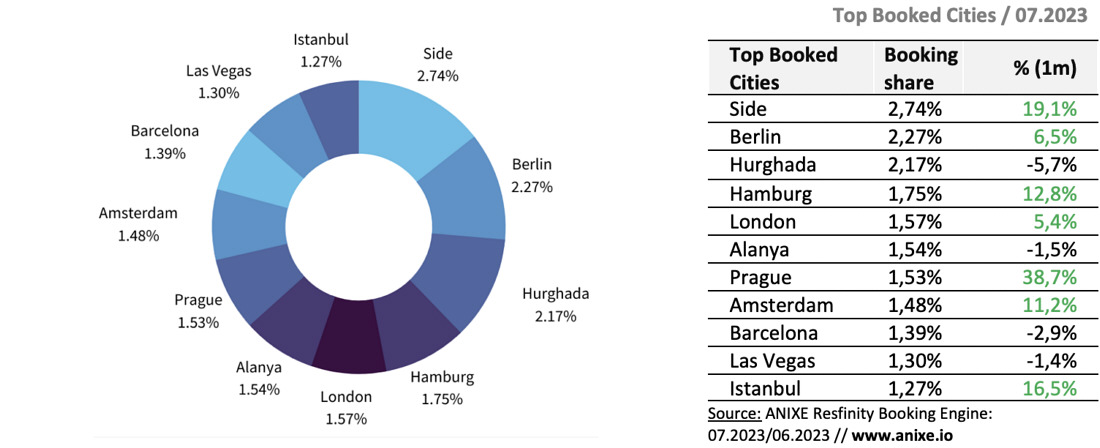

With the arrival of July 2023, German explorers increasingly chose Side, Berlin and Hurghada. The Turkish resort, in particular, saw an increase of 19.1% compared to June, although the growth was not strong enough when juxtaposed with the July 2019 figures (down 20.5%)

The most significant month-to-month declines in popularity were registered for Playa de Palma (158.55), Rome (82.1%) and London (45%). Increases in interest were enjoyed by less popular destinations Prague (9.7%) and Barcelona (2.13%) during the period.

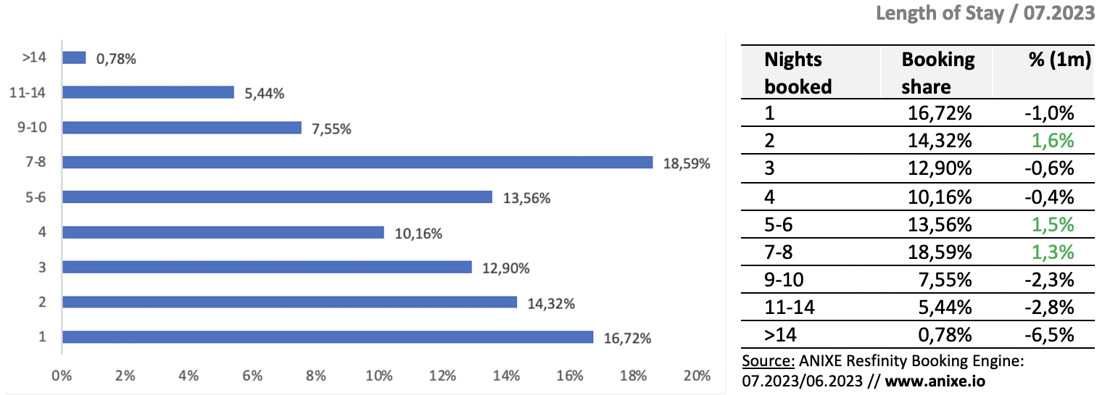

While tourists couldn't resist the magnetic appeal of Spain, Short trips have always been popular in the ANIXE booking system, whether it's a 1-2 day adventure or a quiet week-long getaway. July 2023 values have mostly stayed the same monthly except for the growing trend away from trips of more than 2 weeks.

Compared to the pre-pandemic period, the share of 1- and 3-day trips decreased by an average of 9.5% in favour of 9-10 day trips and 5-6 day trips, which have increased by 26.5% and 13.5%, respectively.

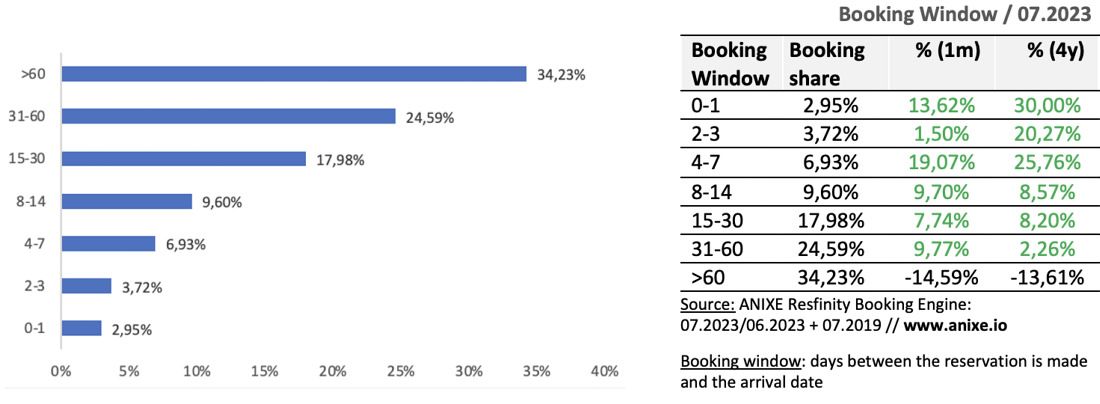

In July 2023, German travellers were eager to embark on their next adventures, planning future trips with a strong interest in bookings more than 60 days in advance. These forward-looking bookings accounted for nearly 35% of all bookings, although they were 14.5% lower than in June and 13.6% lower than four years ago.

This decline, however, was offset by a significant 19% increase in interest in tours with 4-7 days' pre-departure notice. As for last-minute (0-1) thrill seekers, their share may be the smallest, but it remains 13.6% higher than in June 2023 and 30% higher than in the pre-pandemic era.

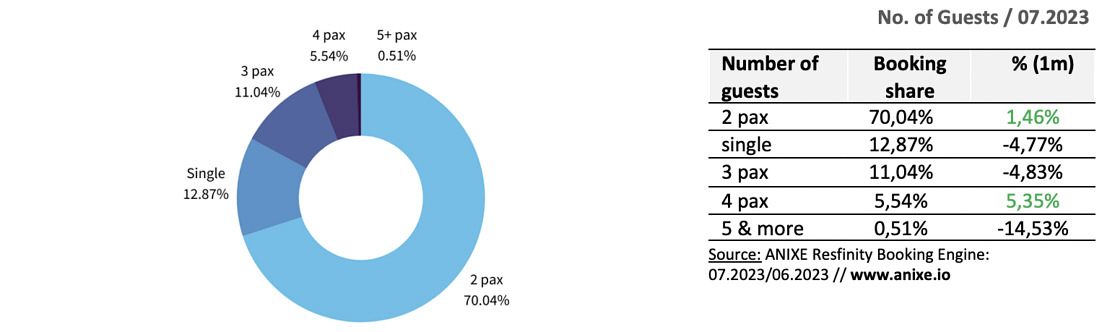

RResfinity's booking data consistently shows that dynamic duos and solo travellers remain the most popular. However, there has been a 4.7% decline in solo bookings since June 2023, and July's result is slightly lower than before the pandemic. Similarly, there has been a 4.8% drop in bookings for groups of three since June 2023. Despite this decline, such bookings are still about 11.6% lower than before the pandemic, indicating clear room for further growth.

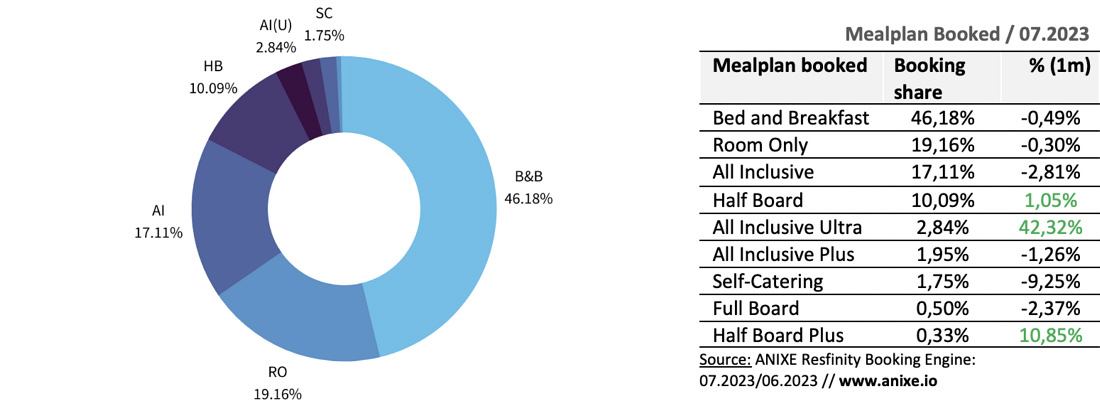

ANIXE Resfinity's booking data reveals a continuing trend: those travelling alone or for two prefer accommodations offering breakfast or a no-meal option. As a result, rooms with a Bed and Breakfast option are the most popular, garnering as much as 46.18% of bookings in July 2023. However, this impressive result is 5% lower than before the pandemic, leaving significant room for growth. Interestingly, bookings of all-inclusive and all-inclusive ultra rooms declined last month, which becomes particularly curious regarding pre-pandemic values. Are travellers abandoning all-inclusive options during the peak season and opting for cheaper alternatives?

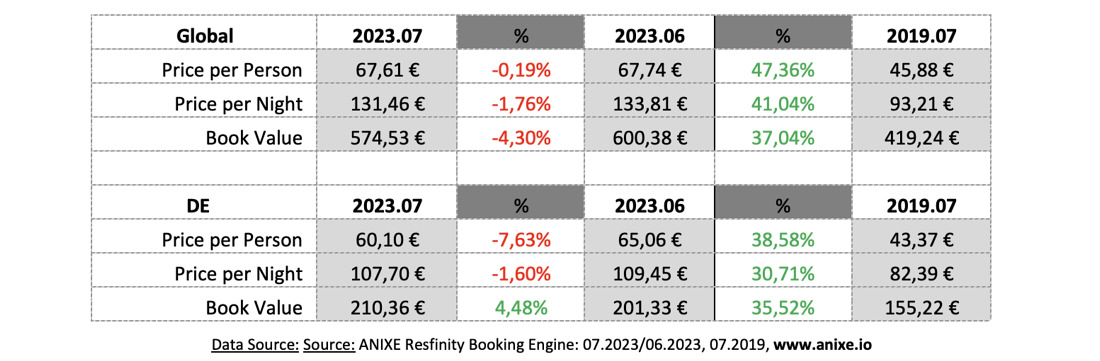

At the start of the summer season, Resfinity data detected a subtle drop in prices in the German market between June and July 2023. It may have been influenced by the numerous fires at seaside resorts, which with promotions, wanted to cover up any inconvenience tourists may have indirectly faced. Booking costs have risen by an average of 35% per capita compared to just four years ago. Meanwhile, prices have risen by a staggering 37% in the global arena. So, while vacationers pay more, they receive less, as evidenced by the decline in all-inclusive bookings.

Aside from localised emergencies, our data proves that European travel is as strong and adaptive as ever. Looking past the numbers, it is clear for all to see, from crowded airports to bustling travel agencies, that demand remains higher and more dynamic than ever, and comparisons to the statistics of the pre-pandemic heydays only confirm this.

European market challenges will continue to persist, with wildfires, war, and steadily rising inflation, and although the latter has begun to slow, hotel rooms, restaurants and car rentals are still experiencing steady increases. Travellers are required to budget more sparingly by opting for lower-cost catering plans, which could have profound effects on the operation of Europe’s most popular destinations and resorts. On the other hand, there is a growing trend toward solo travel, which presents a unique opportunity for travel agents to cater to this market segment by offering customised options and packages.

Will the second half of the holiday season surpass previous summer records? What offerings will travel agencies and hotels in areas affected by natural disasters offer?

Find out in our next report. So, for now…

Stay tuned. Stay safe. Plan your trips. Team ANIXE

(Data origin: ANIXE Resfinity Booking Engine. Data originated from the ANIXE Resfinity IBE travel system.)

.